student loan debt relief tax credit 2020

16 hours agoBiden Cancelled 15 Billion Of Student Debt For Borrowers But You Can Still Apply Now. Millions of Americans waiting for news on the future of their student debt received no more clues from Bidens 2023 budget proposal.

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

Student Loan Debt Relief Tax Credit Application.

. You have incurred at least 20000 in total undergraduate andor graduate student loan debt. Lets Look at an Example. For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will get a 200 refund.

All Maryland taxpayers who maintain Maryland residency for the past tax year may apply by completing the Student Loan Debt Relief Tax Credit application from July 1 through September 15 each year. If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference. The COVID-19 Student Loan Relief Act of 2020 and the Student Borrower Bankruptcy Relief Act of 2019 which would eliminate or amend the section of the Bankruptcy Code that prevents student loans from being dischargeable are before Congress.

The Student Loan Debt Relief Tax Credit Program. Like any other year when you file your taxes you can deduct the interest you paid on your qualified student loans in 2020 up to a certain amount according to the IRS website. Who How and When to Apply.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. The Maryland Higher Education Commissionmay request additional documentation supporting your claim for this or subsequent tax years. Provide automatic cancellation using data already available.

File Maryland State Income Taxes for the 2019 year. If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference. For Maryland Residents or Part-year Residents Tax Year 2020 Only.

These deferred payments dont necessarily apply to private student loans. Incurred at least 20000 in total student loan debt. Until the end of 2020 employers can contribute up to 5250 toward an employees student loan balance and the payment will be free from payroll and income tax under a provision in the Coronavirus Aid Relief and Economic.

Provide partial debt cancellation for each borrower with household gross income between 100001 and 250000 by reducing the cancellation amount by 1 for every 3 in income over 100000. You must provide an email address where MHEC. One of Congresss economic responses to the COVID-19 crisis is a temporary tax incentive for companies to help employees pay their student debt.

Nowhere in President Joe Bidens more than 100-page. During this time borrowers will not be required to. Cancel up to 50000 in student loan debt for borrowers with 100000 or less in household gross income.

Collection activities are currently paused through Nov. The AOTC offers a credit of 100 on the first 2000 of qualifying educational expenses and 25 on the next 2000 for a maximum of 2500. Check with your loan provider for information on relief for debt payment during the COVID-19 pandemic.

What that means is if you only paid 500 in interest then youll only be able to deduct 500 from your return. Yet the administration still appears to be considering an extension to the payment pause as well as debt forgiveness. To qualify for the Student Loan Debt Relief Tax Credit you must.

The Department of Education. If you pay 25 in taxes and you have 10000 of debt forgiven then youd owe 2500. For example if you borrow and then use the money to pay 2000 for your tuition your credit will equal 400.

Student Loan Debt Relief Tax Credit for Tax Year 2020. The Student Loan Debt Relief Tax Credit is a program created under 10. Maryland taxpayers who have incurred at least 20000 in.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. Have at least 5000 in outstanding student loan debt remaining during 2019 tax year. 43 To date this legislation has not been enacted.

ED-held student loans and certain non-ED-held student loans are being placed in a special administrative forbearance for March 13 2020 through May 1 2022. Also due to the American Rescue Plan Act ARP Act any student loan forgiveness passed between Dec 31 2020 and Jan 1 2026 will be tax-free. Student Loan Debt Relief Tax Credit for Tax Year 2020.

However if you paid 5000 in interest youll still only be able to claim that maximum cap of 2500. AnswerThe tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. 2000 tuition payment x 020 20 400 credit.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. As with the American Opportunity Tax Credit the IRS allows you to claim the Lifetime Learning Credit even if you use a qualified student loan to pay for your tuition. You have at least 5000 in outstanding undergraduate student loan debt when you submitted an application for certification to the Maryland Higher Education Commission.

From July 1 2021 through September 15 2021. Paying for higher education. The rule is that you get to deduct the lesser of 2500 or the amount of interest you actually paid.

Instructions are at the end of this application. For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will get a 200 refund. You can claim the Student Loan Debt Relief Tax Credit if you meet the following conditions.

It requires a completely separate form attached to a Form 1040 tax return and receipt of a Form 1098-T from the institution where the student was enrolled. Tax Relief Expanded for Student Loan Debt Discharge in Certain Cases January 16 2020 by Ed Zollars CPA The IRS announced an expansion of relief to additional individuals who borrowed funds to attend school and later had that debt cancelled in. If you pay 35 in taxes and you have 10000 of debt forgiven then youd owe 3500.

As I stated above youll end up being taxed on your forgiveness benefit based on the income tax bracket that you fall under. Congress has previously passed some temporary fixes to student loan forgiveness taxation in recent years. 1 2022 for all federal student loans and commercially held FFEL debt which could protect your 2021 refunds.

Complete the Student Loan Debt Relief Tax Credit application. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

Is Interest On Student Loan Debt Tax Deductible Consolidated Credit Ca

Student Loan Debt Crisis In America By The Numbers Educationdata Org

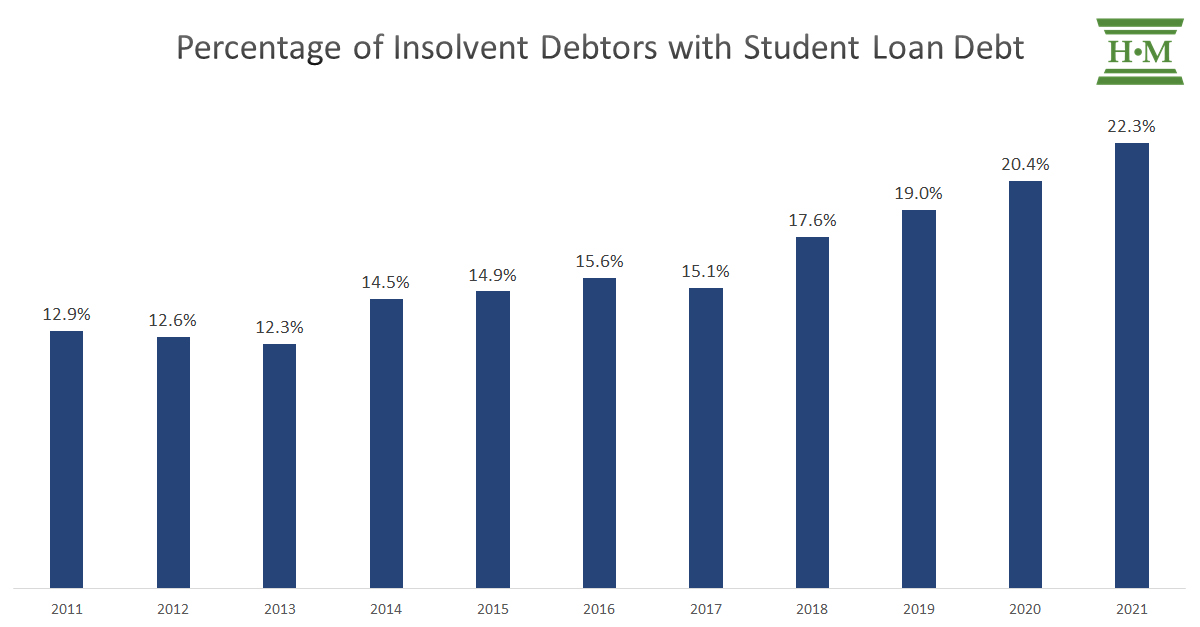

Student Debt Crisis 1 In 6 Canadian Bankruptcies Due To Student Debt Study

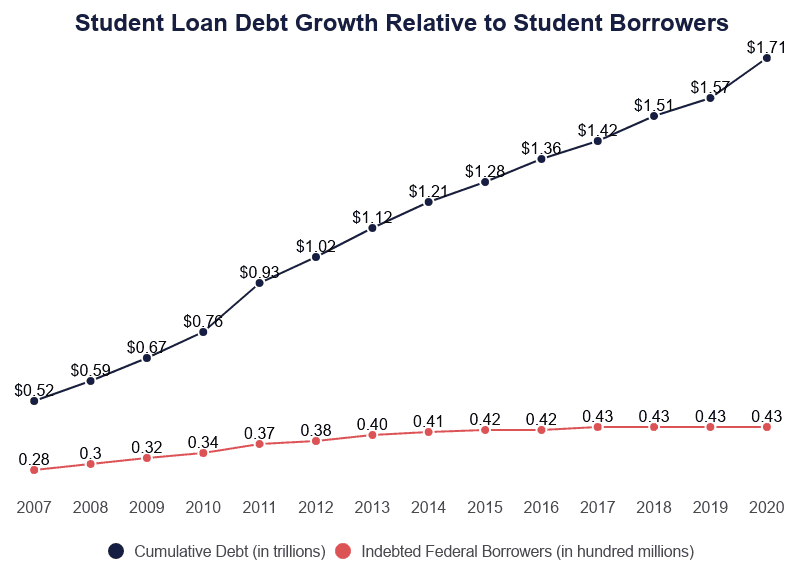

Chart Americans Owe 1 7 Trillion In Student Loans Statista

Can I Get A Student Loan Tax Deduction The Turbotax Blog

50 Say Mass Student Loan Forgiveness Unfair To Former Borrowers Student Loan Hero

Targeting Student Loan Debt Forgiveness To Public Assistance Beneficiaries Third Way

2021 Joe Debtor Bankruptcy Study Who Files Bankruptcy Why Hoyes Michalos

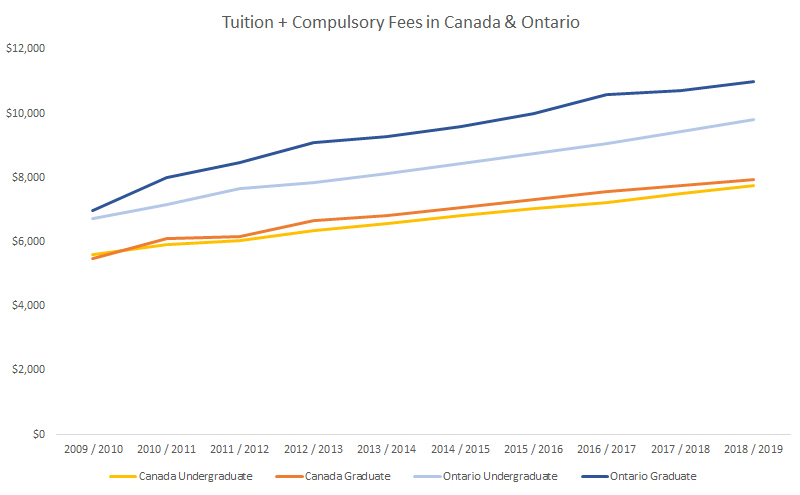

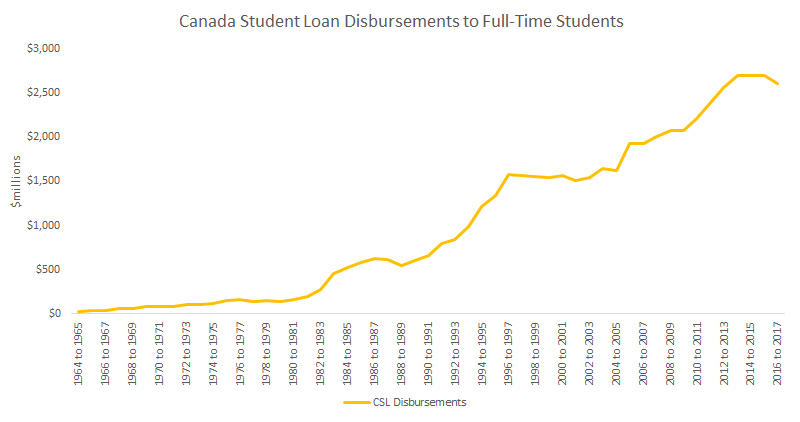

Is Taking On More Student Debt Bad For Students Econofact

How Progressive Is Senator Elizabeth Warren S Loan Forgiveness Proposal

Is Interest On Student Loan Debt Tax Deductible Consolidated Credit Ca

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

What Is The Current Student Debt Situation People S Policy Project

Student Debt Crisis 1 In 6 Canadian Bankruptcies Due To Student Debt Study

Promote Economic And Racial Justice Eliminate Student Loan Debt And Establish A Right To Higher Education Across The United States Equitable Growth

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

What Is The Current Student Debt Situation People S Policy Project

What Is The Current Student Debt Situation People S Policy Project